About

Tax drag is the reduction of potential income caused by income taxes. Although investors most commonly associate tax drag with reduced portfolio returns, tax drag doesn’t just affect portfolios. Tax drag reduces potential income from wages, pensions, IRA and 401k withdrawals, business distributions, and even Social Security benefits. Some taxpayers lose almost 40% of each additional income dollar to taxes.

Tax drag means your clients and their portfolios must work harder to achieve life goals.

Planning to reduce taxes has always been seen as too difficult for anyone but the truly wealthy and their legions of CPAs and tax attorneys. The Internal Revenue Code is complicated with lots of moving parts and interconnected provisions lurking to trip the unsuspecting taxpayer. Plus transactions in one year, often affect transactions and taxes in another year.

So, clients and their advisors often couldn’t fully analyze opportunities to legally reduce tax drag. It was simply too difficult to create multi-year, relevant, understandable, and actionable tax plans.

Until now . . .

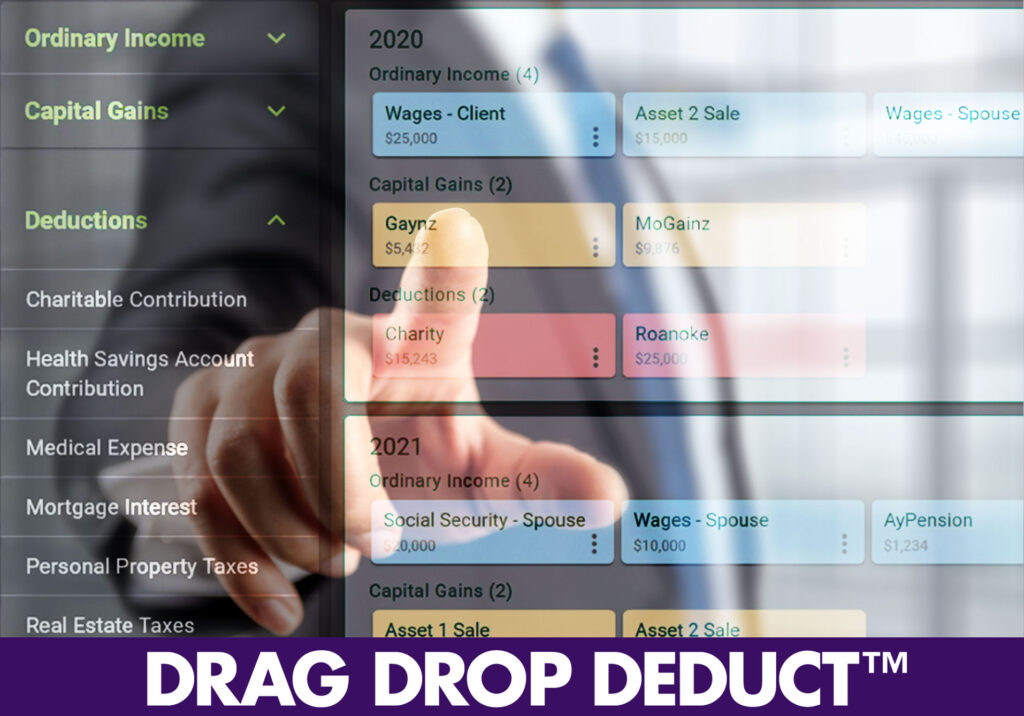

The TaxCast Tax Planning Made Simple™ process allows every advisor to construct multi-year visual tax plans with no advanced tax expertise. TaxCast resulted from a year-long collaboration between a CPA (and practicing Certified Financial Planner professional) and a software architect.

The TaxCast idea – allow advisors to help clients understand the potential effects of different transactions so lifetime tax burdens could be managed and reduced – and to make it simple.

We call the intuitive design Drag Drop Deduct™. By dragging “transaction tiles” among different tax years on a “canvas”, clients see how different decisions affect how much money they keep.

And, TaxCast’s robust calculation engine performs validation checks to prevent clients from planning disallowed transactions. So you can focus on confidently providing advice that will allow your clients to meet their life goals.